UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

LINCOLN ELECTRIC HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Dear Shareholder:

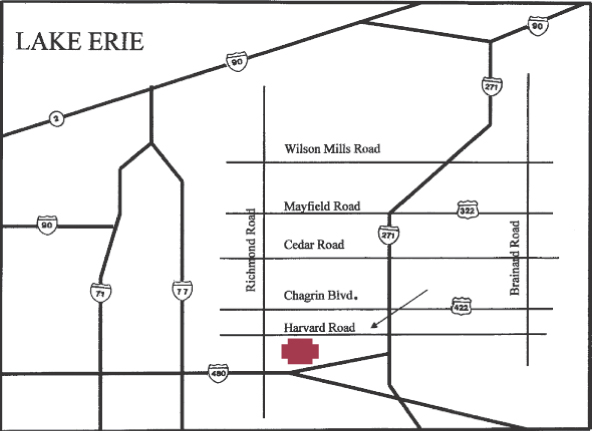

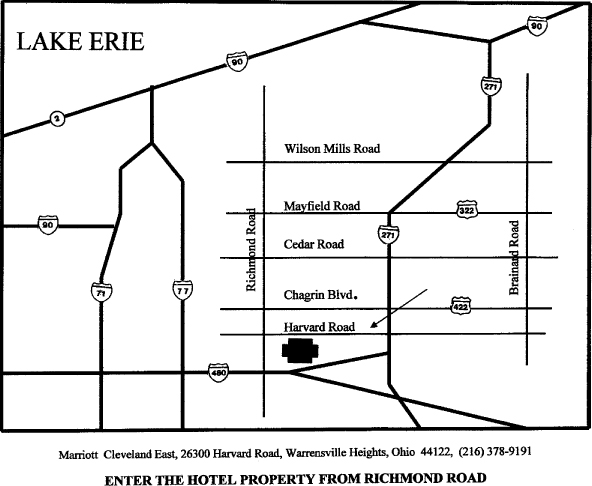

You are cordially invited to attend the Annual Meeting of Shareholders of Lincoln Electric Holdings, Inc. (Lincoln), which will be held at 11:3000 a.m., local time, on Thursday, April 26, 201224, 2014 at the Marriott Cleveland East, 26300 Harvard Road, Warrensville Heights, Ohio. A map showing the location of the Annual Meeting is printed on the outside back cover of the proxy statement.

Enclosed with this letter are the Annual Meeting notice, proxy statement, proxy card and an envelope in which to return the proxy card. Also enclosed is a copy of the Annual Report. The Annual Report and proxy statement contain important information about Lincoln, as well as our Board of Directors and executive officers. Please read these documents carefully.

If you are a registered holder of shares of Lincoln common stock or a participant in The Lincoln Electric Company Employee Savings Plan (401(k) plan), as a convenience to you and as a means of reducing costs, you may choose to vote your proxy electronically using the Internet or a touch-tone telephone instead of using the conventional method of completing and mailing the enclosed proxy card. Electronic proxy voting is permitted under Ohio law and our Amended and Restated Code of Regulations. You will find instructions on how to vote electronically in the proxy statement and on the proxy card. Having the freedom to vote by means of the Internet, telephone or mail does not limit your right to attend or vote in person at the Annual Meeting, if you prefer. If you plan to attend the Annual Meeting, please check the attendance box on the enclosed proxy card or when prompted if you cast your vote over the Internet or by telephone.

We look forward to seeing you at the Annual Meeting.

Sincerely,

John M. Stropki, Jr.Christopher L. Mapes

Chairman, President and Chief Executive Officer

Lincoln Electric Holdings, Inc.

March 23, 201221, 2014

| 1 | ||

| 2 | ||

| 9 | ||

| 9 | ||

| 10 | ||

| 13 | ||

| 21 | ||

| 24 | ||

| 28 | ||

| 29 | ||

| 29 | ||

| 30 | ||

Audit Committee Pre-Approval Policies and Procedures(Proposal 2 continued) | 30 | |

| 32 | ||

| 32 | ||

| 75 | ||

| 82 | ||

| B-1 |

Lincoln Electric Holdings, Inc.

22801 Saint Clair Avenue

Cleveland, Ohio 44117-1199

OF SHAREHOLDERS |

The Annual Meeting of Shareholders of Lincoln Electric Holdings, Inc. will be held at 11:3000 a.m., local time, on Thursday, April 26, 2012,24, 2014, at the Marriott Cleveland East, 26300 Harvard Road, Warrensville Heights, Ohio.

Shareholders will be asked to vote on the following proposals:

| (1) | Election of |

| (2) | Ratification of the appointment of Ernst & Young LLP as our independent auditors for the year ending December 31, |

| (3) | To approve, on an advisory basis, the compensation of our named executive officers; |

| (4) |

|

| (5) | Any other business properly brought before the meeting, or any postponement(s) or adjournment(s) of the meeting. |

Shareholders of record as of the close of business on March 5, 2012,3, 2014, the record date, are entitled to vote at the Annual Meeting.

Frederick G. Stueber

Senior Vice President,

General Counsel and Secretary

March 23, 201221, 2014

Your Vote is Very Important – Please Vote Promptly

Whether or not you plan to attend the Annual Meeting, we recommend that you mark, date, sign and return promptly the enclosed proxy card in the envelope provided or

If your shares are not registered in your own name and you would like to attend the Annual Meeting, please bring evidence of your share ownership with you. You should be able to obtain evidence of your share ownership from the bank, broker, trustee or other nominee that holds the shares on your behalf.

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 26, 2012.24, 2014.

This proxy statement, along with our Annual Report on Form 10-K for the fiscal year ended December 31, 20112013 and our Annual Report, are available free of charge on the following website:www.lincolnelectric.com/proxymaterials.proxymaterials.

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 26, 201224, 2014

| GENERAL INFORMATION |

Who is soliciting proxies and why? Who is paying for the cost of this proxy solicitation?

The enclosed proxy is being solicited by our Board of Directors and we will pay the cost of the solicitation. Certain of our officers and other employees may also solicit proxies by telephone, letter or personal interview but will not receive any additional compensation for these activities. In addition, we reimburse banks, brokers and other custodians, nominees and fiduciaries for reasonable expenses incurred in forwarding proxy materials to beneficial owners of our common stock and obtaining their proxies. We will begin mailing this proxy statement on or about March 23, 2012.21, 2014.

If your shares are held in your name, in order to vote your shares you must either attend the Annual Meeting and vote in person or appoint a proxy to vote on your behalf. Because it would be highly unlikely that all shareholders would be able to attend the Annual Meeting, the Board recommends that you appoint a proxy to vote on your behalf, as indicated on the accompanying proxy card, or appoint your proxy electronically via telephone or the Internet.

How do we distribute materials to shareholders sharing the same address?

To reduce the expense of delivering duplicate voting materials to shareholders who share the same address, we have taken advantage of the “householding” rules enacted by the Securities and Exchange Commission (SEC). As long as we provide proper notice to such shareholders, these rules permit us to deliver only one set of voting materials to shareholders who share the same address, meaning only one copy of the Annual Report, proxy statement and any other shareholder communication will be sent to those households. Each shareholder will, however, receive a separate proxy card.

How do I obtain a separate set of communications to shareholders?

If you share an address with another shareholder and have received only one copy of the Annual Report, proxy statement or any other shareholder communication, you may request that we send a separate copy of these materials to you at no cost to you. For this meeting and for future Annual Meetings, you may request separate copies of these materials. You may also request that we send only one set of these materials to you if you are receiving multiple copies. You may make these requests by sending a written notice to the Corporate Secretary at Lincoln Electric Holdings, Inc., 22801 St. Clair Avenue, Cleveland, Ohio 44117. You may also request separate copies of these materials for this meeting and for future Annual Meetings by calling Roy Morrow,Frederick G. Stueber, our Director of Corporate Relations,Secretary, at 216-383-4893.216-481-8100.

Who may vote?

Record holders of shares of common stock of Lincoln Electric Holdings, Inc. as of the close of business on March 5, 2012,3, 2014, the record date, are entitled to vote at the Annual Meeting. On that date, 83,984,56680,683,177 shares of our common stock were outstanding. Each share is entitled to one vote on each proposal brought before the meeting.

What is required for there to be a quorum at the Annual Meeting?

Holders of at least a majority of the shares of our common stock issued and outstanding on the record date (March 5, 2012)3, 2014) must be present, in person or by proxy, for there to be a quorum in order to conduct business at the meeting. Abstentions and broker non-votes (described below) will count for purposes of determining if there is a quorum.

What is the difference between holding shares as a shareholder of record and as a beneficial holder?

Shareholder of Record. If your shares are registered in your name with our transfer agent/registrar, Wells Fargo Bank, N.A., you are considered the shareholder of record and these proxy materials have been sent directly to you. You may vote in person at the meeting. You may also grant us your proxy to vote your shares by telephone, via the Internet or by mailing your signed proxy/voting instruction card in the postage-paid envelope provided. The card provides the voting instructions.

Beneficial Holder of Shares Held in “Street Name”. If your shares are held in a brokerage account, by a trustee, or by another nominee, then that other person/entity is considered the shareholder of record and the shares are considered held in “street name.” We sent these proxy materials to that other person/entity, and they have been forwarded to you with a voting instruction card. As the beneficial owner of the shares, you have the right to direct your broker, trustee or other nominee on how to vote and you are also invited to attend the meeting. However, if you are a beneficial holder, you are not the shareholder of record and you may not vote your street name shares in person at the meeting unless you obtain a legal proxy from the broker, trustee or nominee that holds your shares, giving you the right to vote them at the meeting. Please refer to the information your broker, trustee or other nominee provided to see what voting options are available to you. If you have not heard from your broker or bank, please contact them as soon as possible.

What shares are included on the proxy card?

If you are both a registered shareholder of our common stock and a participant in The Lincoln Electric Company Employee Savings Plan (401(k) plan), you may have received one proxy card that shows all shares of our common stock registered in your name, including any dividend reinvestment plan shares, and all shares you have (based on the units credited to your account) under the 401(k) plan. Accordingly, your proxy card also serves as your voting directions to the 401(k) plan Trustee.

Please note, however, that unless the identical name(s) appeared on all your accounts, we were not able to consolidate your share information. If that was the case, you received more than one proxy card and must vote each one separately. If your shares are held through a bank, broker, trustee or some other nominee, you will receive either a voting form or a proxy card from them, instructing you on how to vote your shares. This may also include instructions on telephone and electronic voting. If you are both a record holder of shares and a beneficial holder of additional shares, you will receive a proxy card(s) directly from us as well as a voting instruction card from your bank, broker or other nominee.

What is a broker non-vote and what effect does it have?

Brokers or other nominees who hold our common stock for a beneficial owner have the discretion to vote on routine proposals when they have not received voting instructions from the beneficial owner. However, your broker or other nominee is not permitted to vote on your behalf on the election of directors (Proposal 1) and other non-routine matters (including Proposals 3 and 4) unless you provide specific voting instructions to them by completing and returning the voting instruction card sent to you or by following the instructions provided to you by your broker, trustee or nominee to vote your shares via telephone or the Internet.

A broker non-vote occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares.Therefore, if you hold your shares beneficially through a broker, trustee or other nominee, you must communicate your voting instructions to them to have your shares voted.

Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting, but will not be counted for purposes of determining the number of votes present in person or represented by proxy and entitled to vote (i.e., it will not be considered a vote “cast”) with respect to a particular proposal.

What proposals am I being asked to vote on and what vote is required to approve each proposal?

You are being asked to vote on fourthree proposals on the proxy card:

Proposal 1 (Election of Directors) requests the election of four Directors.five Directors to the Class of 2017. You can specify whether your shares should be voted for all, some or none of the nominees. Under Ohio law and our Articles of Incorporation, if a quorum is present, the Director nominees receiving the greatest number of votes will be elected (plurality). However, we have adopted a majority voting policy that is applicable in uncontested elections of Directors. This means that the plurality standard will determine whether a Director nominee is elected, but our majority voting policy will further require that the number of votes cast “for” a Director must exceed the number of votes “withheld” from that Director or the Director must submit his or her resignation. The Nominating and Corporate Governance Committee would then consider whether to accept or reject the resignation. Broker non-votes and abstentions will have no effect on the election of Directors and are not counted under our majority voting policy. Holders of our common stock do not have cumulative voting rights with respect to the election of directors.

Proposal 2 (Ratification of Independent Auditors) requests that shareholders ratify the appointment of Ernst & Young LLP as our independent auditors. You can specify whether you want to vote “for” or “against”,“against,” or abstain from voting for this proposal. Proposal 2 requires the affirmative vote of a majority of the shares of Lincoln common stock present or represented by proxy and entitled to vote on the matter when a quorum is present. This means that the number of votes cast “for” the proposal must exceed the number of votes cast “against” the proposal. Votes on Proposal 2 that are marked “abstain” will have the same effect as votes “against” the proposal.

Proposal 3 (Advisory Vote on Executive Compensation) requests an advisory vote on our executive compensation. We make this request on an annual basis. You may vote “for” or “against’,“against,” or abstain from voting for this proposal. Although the vote is not binding on us, Proposal 3 requires the affirmative vote of a majority of the shares of Lincoln common stock present or represented by proxy and entitled to vote on the matter when a quorum is present. This means that the number of votes cast “for” the proposal must exceed the number of votes “against” the proposal. Votes on Proposal 3 that are marked “abstain” will have the same effect as votes “against” the proposal. Broker non-votes will have no effect on the results of this proposal.

Proposal 4 (Re-Approval of Performance Measures under our 2007 Management Incentive Compensation Plan (2007 MICP)) requests that the shareholders re-approve the performance measures under that plan. You may vote “for” or “against”, or abstain from voting for this proposal. Proposal 4 requires the affirmative vote of a majority of the shares of Lincoln common stock present or represented by proxy and entitled to vote on the matter when a quorum is present. This means that the number of votes cast “for” the proposal must exceed the number of votes “against” the proposal. Votes on Proposal 4 that are marked “abstain” will have the same effect as votes “against” the proposal. Broker non-votes will have no effect on the results of this proposal.

The Board is asking for your vote on Proposal 3 pursuant to requirements under Section 14A of the Securities Exchange Act of 1934. Currently, advisory “Say on Pay” votes are scheduled to be held once every year, with the 20132014 vote expected to occur at our 20132014 Annual Meeting.

Proposal 4 (Declassify our Board of Directors) requests that shareholders approve amendments to our Amended and Restated Code of Regulations that, if adopted, would eliminate the classified structure of our Board of Directors over a three-year period. The declassification of our Board would be phased in starting with the 2015 Annual Meeting so that Directors up for election in 2015 would be elected to a one-year term. As a result, beginning with the election of Directors at the 2016 Annual Meeting, a majority of the Board would stand for election annually, and, beginning with the 2017 Annual Meeting, all Directors would stand for election annually. You may vote “for” or “against,” or abstain from voting on this proposal. Proposal 4 requires the affirmative vote of the holders of shares entitled to exercise not less than two-thirds (2/3) of the voting power of Lincoln shares. This means that two-thirds (2/3) of the voting power must be received in order for this proposal to pass. Broker non-votes and abstentions on Proposal 4 will have the same effect as votes “against” the proposal.

Our Directors do not know of any other matters that are to be presented at the meeting. If any other matters come before the meeting of which we failed to receive notice within the 30-day period from December 31, 201126, 2013 through January 30, 201225, 2014 (or that applicable laws otherwise would permit proxies to vote on a discretionary basis), it is intended that the persons authorized under solicited proxies will vote on the matters in accordance with their best judgment.

How do I vote?

Registered Holders

If your shares are registered in your name, you may vote in person or by proxy in any ONE of the following ways.ways:

| • | Using a Toll-Free Telephone Number. After reading the proxy materials and with your proxy card in front of you, you may call the toll-free number1-800-690-6903 |

| • | Over the Internet. After reading the proxy materials and with your proxy card in front of you, you may use a computer to access the websitewww.proxyvote.com. Have the information that is printed on your proxy card, in the box marked by the arrow |

By Mail. After reading the proxy materials, you may mark, sign and date your proxy card and return it in the enclosed prepaid and addressed envelope.

In Person at the Meeting. If you plan to attend the Annual Meeting in person, you must provide proof of your ownership of our common stock and a form of personal identification for admission to the meeting. If you hold your shares in street name, and you also wish to vote at the meeting, you must obtain a proxy, executed in your favor, from your bank or broker.NOTE: Because 401(k) plan shares are held in a qualified plan, you are not able to vote 401(k) plan shares in person at the Annual Meeting.

The Internet and telephone voting procedures have been set up for your convenience and have been designed to authenticate your identity, allow you to give voting instructions and confirm that those instructions have been recorded properly.

Participants in the 401(k) Plan

If you participate in the 401(k) plan, the plan’s independent Trustee, Fidelity Management Trust Company, will vote your 401(k) plan shares according to your voting directions. You may give your voting directions to the plan Trustee in any ONE of the three ways set forth above under “Registered Holders.” If you do not return your proxy card or do not vote over the Internet or by telephone, the Trustee will not vote your plan shares. Each participant who gives the Trustee voting directions acts as a named fiduciary for the 401(k) plan under the provisions of the Employee Retirement Income Security Act of 1974, as amended.

Beneficial holdersHolders of shares heldShares Held in “street-name”“Street Name”

If your shares are held by a bank, broker, trustee or some other nominee (in street-name)street name), that entity will give you separate voting instructions. Brokers and other nominees are not entitled to vote on the election of Directors, the advisory vote on executive compensation, or the re-approvalproposal to declassify our Board of the performance measures under our 2007 MICPDirectors, unless they receive voting instructions from the beneficial owner. Therefore, it is important that you instruct your bank, broker or other nominee on how you want your shares voted.

What happens if I sign, date and return my proxy but do not specify how I want my shares voted on the proposals?

Registered Shareholders

If you sign, date and return your proxy card but do not specify how you want to vote your shares, your shares will be votedFORthe election of all of the Director nominees,FORthe ratification of the appointment of our independent auditors,FORthe approval of the compensation of our named executive officers andFOR the re-approvalproposal to declassify our Board of the performance measures under our 2007 MICP.Directors.

“Street-Name”Street Name” Shareholders

Your broker or nominee may vote your uninstructed shares only on those proposals on which it has discretion to vote. Your broker or nominee does not have discretion to vote your uninstructed shares on non-routine matters such as the electionProposal 1 (election of Directors (Proposal 1)Directors), Proposal 3 (advisory vote on executive compensation), and Proposal 4 (re-approval(declassify the Board of performance measures under the 2007 MICP)Directors). However, your broker or nominee does have discretion to vote your uninstructed shares on routine matters such as Proposal 2 (ratification of independent auditors).

May I revoke my proxy or change my vote?

Yes. You may change or revoke your proxy prior to the closing of the polls in any one of the following FOUR ways:

| 1. | by sending a written notice to our Corporate Secretary stating that you want to revoke your proxy; |

| 2. | by submitting a properly completed and signed proxy card with a later date (which will automatically revoke the earlier proxy); |

| 3. | by entering later-dated telephone or Internet voting instructions (which will automatically revoke the earlier proxy); or |

| 4. | by voting in person at the Annual Meeting after requesting that the earlier proxy be revoked.NOTE: Because 401(k) plan shares are held in a qualified plan, you are not able to revoke or change your vote on 401(k) plan shares at the Annual Meeting. |

If your shares are held by a bank, broker, trustee or some other nominee, you will have to check with your bank, broker, trustee or other nominee to determine how to change your vote. Also note that if you plan to attend the Annual Meeting, you will not be able to vote in person at the meeting any of your shares held by a nominee unless you have a valid proxy from the nominee. If you plan to attend the Annual Meeting, please check the attendance box on the enclosed proxy card or indicate so when prompted if you are voting by telephone or over the Internet.

Who counts the votes?

We have engaged Broadridge Financial Solutions, Inc. as our independent agent to receive and tabulate the votes. Broadridge will separately tabulate “for”,“for,” “against” and “withhold” votes, abstentions and broker non-votes. Broadridge will also act as our inspector of elections at the Annual Meeting. All properly signed proxy cards and all properly recorded Internet and telephone votes (including votes marked “abstain” and broker non-votes) will be counted to determine whether or not a quorum is present at the meeting.

May I receive future shareholder communications over the Internet?

If you are a registered shareholder, you may consent to receiving future shareholder communications (e.g.(e.g., proxy materials, Annual Reports and interim communications) over the Internet instead of the mail. You give your consent by marking the appropriate box on your proxy card or following the prompts given you when you vote by telephone or over the Internet. If you choose electronic access, once there is sufficient interest in electronic delivery, we will discontinue mailing proxy statements and Annual Reports to you. However, you will still receive a proxy card, together with a formal notice of the meeting, in the mail.

Providing shareholder communications over the Internet will reduce our printing and postage costs and the number of paper documents that you would otherwise receive. If you give your consent, there is no cost to you for this service other than charges you may incur from your Internet provider, telephone and/or cable company. Once you give your consent, it will remain in effect until you inform us otherwise.

If your shares are held through a bank, broker, trustee or some other nominee, check the information provided by that entity for instructions on how to choose to access future shareholder communications over the Internet.

In addition, our Annual Report on Form 10-K for the fiscal year ended December 31, 2011,2013, Annual Report and this proxy statement are available free of charge on the following website:www.lincolnelectric.com/proxymaterials.

When are shareholder proposals due for the 2012next year’s Annual Meeting?Meeting in 2015?

In order for proposals to be considered for inclusion in next year’s proxy statement for the 20132015 Annual Meeting, a shareholder proposal submitted under Rule 14a-8 of the Securities Exchange Act of 1934 must be received in writing by the Corporate Secretary at Lincoln Electric Holdings, Inc., 22801 Saint Clair Avenue, Cleveland, Ohio 44117-1199 on or before November 23, 201221, 2014, and it must otherwise comply with Rule 14a-8. In addition, if shareholders want to present proposals at our 20132015 Annual Meeting other than through the process set forth in Rule 14a-8, they must comply with the requirements set forth in our Amended and Restated Code of Regulations, which we refer to as our “Regulations.” Specifically, they must provide written notice containing certain information as described in our Regulations and such notice must be received no later than January 26, 201324, 2015 and no earlier than December 27, 2012.25, 2014. If notices delivered pursuant to the Regulations are not timely received, then we will not be required to present such proposals at the 20132015 Annual Meeting. If the Board of Directors chooses to present any information submitted after the deadlines set forth in the Regulations at the 20132015 Annual Meeting, then the persons named in proxies solicited by the Board for the 20132015 Annual Meeting may exercise discretionary voting power with respect to such information.

May I submit a nomination for Director?

Our Amended and Restated Code of Regulations (Regulations) permit shareholders to nominate one or more persons for election as a Director but require that nominations be received in the Corporate Secretary’s Office at least 80 days before the date of the annual meeting at which the nomination is to be made, as long as we publicly announced the date of the annual meeting more than 90 days prior to the annual meeting date. Alternatively, shareholder nominations for Director must be received in the Corporate Secretary’s Office no later than the close of business on the tenth day following the day on which we publicly announced the date of the annual meeting in those instances when we have not publicly announced the date of the annual meeting more than 90 days prior to the annual meeting date. For complete details on the nomination process, contact our Corporate Secretary at the address below.

To nominate a candidate for election as Director, you must send a written notice to the Corporate Secretary at Lincoln Electric Holdings, Inc., 22801 Saint Clair Avenue, Cleveland, Ohio 44117-1199. The notice must include certain information about you as a shareholder of Lincoln and about the person you intend to nominate, including a statement about the person’s willingness to serve, if elected. Specifically, each notice must include: (1) the name and address of the shareholder who intends to make the nomination and of the person(s) to be nominated, (2) a representation that the shareholder is a holder of record of stock of Lincoln entitled to vote for the election of directors on the date of such notice and intends to appear in person or by proxy at the meeting to nominate the person(s) specified in the notice, (3) a description of all arrangements or understandings between the shareholder and each nominee and any other person(s) (naming such person(s)) pursuant to which the nomination(s) are to be made by the shareholder, (4) such other information regarding each nominee proposed by the shareholder as would be required to be included in the proxy statement filed pursuant to the proxy rules of the SEC, had the nominee been nominated, or intended to be nominated, by our Board of Directors, and (5) the consent of each nominee to serve as a director of Lincoln if so elected.

For this year’s Annual Meeting, we had to receive nominations not later than the close of business on February 6, 20123, 2014 as we publicly announced the date of this year’s Annual Meeting on January 19, 2012,16, 2014, which is more than 90 days prior to this year’s Annual Meeting date. Accordingly, no additional nominations can be made for this year’s Annual Meeting.

How do I contact Lincoln?

For general information, shareholders may contact Lincoln at the following address:

Lincoln Electric Holdings, Inc.

22801 Saint Clair Avenue

Cleveland, Ohio 44117-1199

Attention: Roy Morrow,Amanda Butler, Director, CorporateInvestor Relations

Throughout the year, you may visit our website atwww.lincolnelectric.com for information about current developments at Lincoln.

How do I contact the Directors?

Shareholders may send communications to any or all of our Directors through the Corporate Secretary at the following address:

Lincoln Electric Holdings, Inc.

22801 Saint Clair Avenue

Cleveland, Ohio 44117-1199

Attention: Corporate Secretary

The name of any specific intended Board recipient should be noted in the communication. The Corporate Secretary will forward such correspondence only to the intended recipients. Prior to forwarding any correspondence, the Corporate Secretary will review such correspondence and, in his discretion, not forward certain items if they are deemed of a frivolous nature or otherwise inappropriate for the Board’s consideration. In such cases, some of that correspondence may be forwarded elsewhere within Lincoln for review and possible response.

PROPOSAL 1

|

(PROPOSAL 1)

Our Regulations currently provide for three classes of Directors whose terms expire in different years. Ohio’s General Corporation Law provides that, unless another voting standard is stipulated in the Articles of Incorporation, if a quorum is present, the Director nominees receiving the greatest number of votes will be elected as Directors of Lincoln (plurality)(plurality standard). In addition, we have adopted a majority voting policy with respect to uncontested elections of Directors. The majority voting policy is described in detail below under “Corporate Governance.” Accordingly, for the 20122014 Annual Meeting, the plurality standard will determine whether a Director nominee is elected but, under our majority voting policy, if any Director fails to receive a majority of the votes cast in his or her favor, the Director will be required to submit his or her resignation to the Board promptly after the certification of the election results. The Nominating and Corporate Governance Committee of the Board would then consider each resignation and recommend to the Board whether to accept or reject it.

During 2012, theUnder our current classified Board increased its size from 11 to 12 Directors and, on February 23, 2012, Mr. Curtis E. Espeland was elected by the Directors then in office to fill the vacancy created by the Board expansion. Mr. Espeland joined the classstructure, of Directors whose term ends at this year’s Annual Meeting. Mr. Espeland was recommended as a Director by a search consultant (James Drury Partners) not retained by the Board. Management then referred the matter to Mr. Adams, our Lead Director and Chair of the Nominating and Corporate Governance Committee, who, in conjunction with other members of the Board and the Committee, reviewed Mr. Espeland’s skills and qualifications against the criteria used to assess director candidates (as described in our Guidelines on Significant Corporate Governance Issues).

Each of our three classes of Directors currently has four Directors. Of our three Director classes, one class will hold office until 2012the 2014 Annual Meeting, one class will hold office until the 20132015 Annual Meeting and one class will hold office until the 20142016 Annual Meeting, in each case to serve until their successors are duly elected and qualified. Should Proposal 4 (declassify our Board of Directors) pass by the required two-thirds (2/3) vote, the declassification process will commence with the Directors scheduled for election in 2015. Accordingly, if the declassification proposal passes, the Directors up for election at this Annual Meeting to serve until 2017 will be elected to a three-year term, and the class of Directors up for election at the 2015 Annual Meeting will be the first class of Directors up for election for a one-year term.

Election of FourFive Directors to Serve Until 20152017

At the 20122014 Annual Meeting, fourfive Directors will be elected to serve for a three-year term until the 20152017 Annual Meeting and until their successors are duly elected and qualified. Unless otherwise directed, shares represented by proxy will be votedFORthe following:

Class of 2015.2017. The class of Directors whose term ends in 20152017 has been fixed at four.five.HaroldDavid H. Gunning, G. Russell Lincoln, Christopher L. Adams, Curtis E. Espeland, RobertMapes, Phillip J. KnollMason and John M. Stropki, Jr.Hellene S. Runtagh are standing for election. All of the nominees have been elected previously by the shareholders, except for Mr. EspelandMason who joined our Board in July 2013. Mr. Mason was elected to the Board in February 2012.upon the recommendation of the Nominating and Corporate Governance Committee after a board search firm sent the Company his credentials.

Each of the nominees has agreed to stand for election and has agreed, in accordance with our majority voting policy, to tender his resignation in the event that he or she fails to receive a majority of the votes cast in his or her favor. If any of the nominees is unable to stand for election, the Board may provide for a lesser number of nominees or designate a substitute. In the latter event, shares represented by proxies solicited by the Directors may be voted for the substitute. We have no reason to believe that any of the nominees will be unable to stand for election.

YOUR BOARD OF DIRECTORS RECOMMENDS A

PHILLIP J. TO THE CLASS OF 2017

|

PROPOSAL 1(CONTINUED)

Annual Meeting Attendance

Directors are expected to attend each annual meeting. All of the Director nominees, as well as the continuing Directors, plan to attend this year’s Annual Meeting. At the 20112013 Annual Meeting, all of our Directors serving on the Board at such time were in attendance.

DIRECTOR BIOGRAPHIESattendance, except for Mr. Mason, who did not join our Board until July 2013.

The following table sets forth biographical information about the Director nominees and the Directors whose terms of office will continue after this Annual Meeting. Except as otherwise indicated, each of the Director nominees and continuing Directors has held the occupation listed below for more than five years.

None of the Director nominees or continuing Directors has any special arrangement or understanding with any other person pursuant to which the Director nominee or continuing Director was or is to be selected as a Director or nominee. There are no family relationships, as defined by SEC rules, among any of our Directors or executive officers. SEC rules define the term “family relationship” to mean any relationship by blood, marriage or adoption, not more remote than first cousin.

DIRECTOR NOMINEES FOR ELECTION FOR CLASS OF 2017

Harold L. Adams

|

Term Expires/Service: 2014 – Director since 1987 and Lead Director since April 2013. Recent Business Experience: Mr. Gunning is the former Vice Chairman of Cliffs Natural Resources, Inc. (an iron ore and coal mining company formerly known as Cleveland-Cliffs Inc), a position he held from 2001 until his retirement in 2007. Prior to that, Mr. Gunning served as Chairman, President and Chief Executive Officer of Capital American Financial Corp. Mr. Gunning is also a lawyer and practiced law for many years as a corporate partner with Jones Day. Directorships: Mr. Gunning is a member of the Board of Directors of MFS Funds, Inc. (since 2004). Mr. Gunning served on the Boards of Directors of Cliffs Natural Resources, Inc. (2001 to 2007), Portman Mining Ltd. (2005 to 2008), Southwest Gas Corporation (2000 to 2004) and Development Alternatives, Inc. (pre-1993 to May 2013). Director Qualifications: Mr. Gunning brings to the Board (and its Compensation and Executive Development and Nominating and Corporate Governance Committees) chief executive officer and senior management experience (with public companies), public company board experience and corporate legal skills. Additionally, Mr. Gunning’s relatively long tenure as a Director provides the Board with a valuable perspective on Lincoln’s challenges within its industry. |

PROPOSAL 1(CONTINUED)

| G. Russell Lincoln, Age 67 Term Expires/Service:2014 – Director since 1989. Recent Business Experience: Mr. Lincoln is President of N.A.S.T. Inc. (a personal investment firm), a position he has held since 1996. Prior to joining N.A.S.T. Inc., Mr. Lincoln served as the Chairman and Chief Executive Officer of Algan, Inc. Director Qualifications: As an entrepreneurial businessman with experience, including 25 years running a $50 million business, Mr. Lincoln understands business risk and the importance of hands-on management. Mr. Lincoln is the grandson of J. F. Lincoln, who pioneered the use of incentive management, and he appreciates our corporate culture. His leadership role and his investment experience serve Lincoln Electric well as a member of the Audit and Finance Committees of the Board. | |

|

Term Expires/Service: 2014 – Recent Business Experience: Mr. Mapes is Chairman, President and Directorships: Mr. Mapes is a member of the Board of Directors of The Timken Company (since February 14, 2014). Director Qualifications: As an experienced executive officer of Lincoln as well as other large, global public companies engaged in manufacturing operations, Mr. Mapes understands the manufacturing industry and the challenges of global growth. He is also familiar with the welding industry generally, given his service to Lincoln as Chief Executive Officer and Chief Operating Officer and that one of his former employers (Superior Essex) has been a supplier to Lincoln. In addition to his business management experience, Mr. Mapes has a law degree. | |

PROPOSAL 1(CONTINUED)

| Phillip J. Mason, Age 63 Term Expires/Service: 2014 – Director since July 2013. Recent Business Experience: Mr. Mason is the former President of the Europe, Middle East & Africa Sector (EMEA Sector) of Ecolab, Inc. (a leading provider of food safety, public health and infection prevention products and services), a position he held from 2010 until his retirement in 2012. Mr. Mason brings 35 years of international business experience to the Board and its Audit and Finance Committees, including starting, developing and growing businesses abroad in both mature and emerging markets. Prior to leading Ecolab’s EMEA Sector, Mr. Mason had responsibility for Ecolab’s Asia Pacific and Latin America businesses as President of Ecolab’s International Sector from 2005 to 2010 and as Senior Vice President, Strategic Planning in 2004. Director Qualifications: Mr. Mason has over 35 years of international business experience with experience in establishing businesses in China, South Korea, Southeast Asia, Brazil, India, Russia, Africa and the Middle East. Mr. Mason’s executive leadership of an international business sector for a U.S. publicly-held company provides him with extensive international business expertise in a business-to-business environment, including industrial sectors. Additionally, he brings a strong finance and strategic planning background, including merger and acquisition experience, along with significant experience working with and advising boards on diverse issues confronting companies with international operations. | |

| Hellene S. Runtagh, Age 65 Term Expires/Service: 2014 – Director since 2001. Recent Business Experience: Ms. Runtagh is the former President and Chief Executive Officer of the Berwind Group (a diversified pharmaceutical services, industrial manufacturing and real estate company), a position she held in 2001. From 1997 through 2001, Ms. Runtagh was Executive Vice President of Universal Studios (a media and entertainment company). Prior to joining Universal Studios, Ms. Runtagh spent 27 years at General Electric Company (a diversified industrial company) in a variety of leadership positions. Directorships: Ms. Runtagh has served on the Board of Directors of Harman International Industries, Inc. since 2008 and NeuStar, Inc. since 2006. In addition, Ms. Runtagh was a member of the Board of Directors of IKON Office Solutions Inc. from 2007 to 2008, Avaya Inc. from 2003 to 2007 and Covad Communications Group from 1999 to 2006. Director Qualifications: Ms. Runtagh has over 30 years of experience in management positions with global companies. Ms. Runtagh’s responsibilities in management have ranged from marketing and sales to finance, as well as engineering and manufacturing. Ms. Runtagh’s diverse management experience, including growing those businesses while maintaining high corporate governance standards, and her extensive experience as a director of public companies, make her well-positioned for her role as a Director, member of the Compensation and Executive Development Committee (where she is Chair) and member of the Nominating and Corporate Governance Committee. | |

Class of 2015

| Harold L. Adams, Age 74 Term Expires/Service: 2015 – Director since 2002. Recent Business Experience:Mr. Adams has been Chairman Emeritus of RTKL Associates Inc. (an architectural and engineering firm) since 2003, and is the former Chairman, President and Chief Executive Officer of RTKL, a position he held from 1967 to 2003. | |

Directorships: | Mr. Adams has been a member of the Board of Directors of Commercial Metals Company since 2004 and Legg Mason, Inc. since 1988. | |

Director Qualifications: | Mr. Adams served for 36 years as Chairman, President and Chief Executive Officer of an international architectural firm with 14 offices worldwide. Mr. Adams has also served as a leader on U.S. business advisory councils with Korea and China and the Services Policy Advisory Board to the U.S. Trade Negotiator, and is Chairman of the Governor’s International Advisory Council for the State of Maryland. In these roles, Mr. Adams worked in every major international market in a myriad of economic climates and cultures. He also supervised the Chief Financial Officer and accounting department, dealing with independent auditors on global financial issues. | |

Curtis E. Espeland

|

| |

|

Term Expires/Service: 2015 – | |

Recent Business Experience: | Mr. Espeland has been Senior Vice President and Chief Financial Officer of Eastman Chemical Company (a chemical, fiber and plastic manufacturer) since 2008. Prior to his service as Senior Vice President and Chief Financial Officer, Mr. Espeland was Vice President, Finance and Chief Accounting Officer of Eastman Chemical from 2005 to 2008. | |

Director Qualifications: | Mr. Espeland has extensive experience in corporate finance and accounting, having served in various finance and accounting roles, and ultimately as the Chief Financial Officer, at a large publicly-traded company (Eastman Chemical) for the past several years. Mr. Espeland also has significant experience in the areas of mergers and acquisitions, taxation and enterprise risk management. Mr. Espeland also served as an independent auditor at Arthur Andersen LLP having worked in both the United States and abroad (Europe and Australia). Mr. Espeland’s extensive accounting and finance experience, the Board has determined, qualifies him as | |

Robert J. KnollCONTINUING DIRECTORS(CONTINUED)

|

| |

Term Expires/Service: |

| |

Recent Business Experience: | Mr. Knoll is a former Partner of Deloitte & Touche LLP (an accounting firm), a position he held from 1978 to his retirement in 2000. From 1995 to 1999, Mr. Knoll served as National Director of the firm’s Accounting and Auditing Professional Practice with oversight responsibility for the firm’s accounting and auditing consultation process, SEC practice and risk management process. | |

Director Qualifications: | Mr. Knoll brings a wealth of accounting and auditing experience, with 32 years as a certified public accountant and 22 years as a partner at Deloitte & Touche LLP. Mr. Knoll’s experience directing complex audit processes, and his understanding of the operations of international manufacturing companies similar to Lincoln, provides the Board with valuable expertise and, the Board has determined, qualifies Mr. Knoll as | |

John M. StropkiClass of 2016

|

| |

Term Expires/Service: |

| |

Recent Business Experience: | Mr. Directorships: Mr. Hanks is | |

|

| |

|

| |

CONTINUING DIRECTORSprivately-owned.

Stephen G. Hanks

|

| |

|

| |

|

| |

|

| |

Director Qualifications: | Mr. Hanks’ executive leadership of a U.S. publicly-held company with international reach has provided him with extensive experience dealing with the issues that | |

Kathryn Jo LincolnCONTINUING DIRECTORS(CONTINUED)

|

| |

Term Expires/Service: |

| |

Recent Business | Experiences:Ms. Lincoln is Chair/Chief Investment Officer of the Lincoln Institute of Land Policy (a non-profit educational institution teaching land economics and taxation), a position she has held since 1996. Ms. Lincoln also served as President of the Lincoln Foundation, Inc. (a non-profit foundation that supported the foregoing Institute until the two entities merged in 2006) from 1999 through 2006. | |

Directorships: | Ms. Lincoln is an Advisory Board Member of the Johnson Bank, Arizona Region, a position she has held since 2006, before which she was a Board Member of Johnson Bank Arizona, N.A. beginning in 2001. | |

Director Qualifications: | Ms. Lincoln’s leadership experience with a non-profit education and research institution where she has played a crucial role in strategic planning and asset allocation, as well as her experience with the Chautauqua Institution and an international non-profit organization related to land use/policy, make Ms. Lincoln a valuable contributor to a well-rounded board. Ms. Lincoln serves as a member of the Compensation and Executive Development and Nominating and Corporate Governance Committees. In addition, as a Lincoln family member and long-standing Director of Lincoln Electric, Ms. Lincoln has a keen sense of knowledge about Lincoln Electric and its founding principles. | |

William E. MacDonald, III

|

| |

|

Term Expires/Service: 2016 – Director since 2007. | |

Recent Business | Experiences:Mr. MacDonald is the former Vice Chairman of National City Corporation (a diversified financial holding company), a position he held from 2001 until his retirement in 2006, where he was responsible for its seven-state regional and national corporate banking businesses, the Risk Management and Credit Administration unit, Capital Markets and the Private Client Group. Mr. MacDonald joined National City in 1968 and, during his tenure, held a number of key management positions, including Senior Executive Vice President of National City Corporation and President and Chief Executive Officer of National City’s Ohio bank. | |

Directorships: | Mr. MacDonald | |

Director Qualifications: | Mr. MacDonald brings experience in leading a large corporate organization with over 35,000 employees and structuring complex financing solutions for large and middle-market businesses to the Board and its Compensation and Executive Development and Finance Committees. In addition to his expertise in economic issues, Mr. MacDonald appreciates the human resources and development challenges facing a global, publicly-traded company. | |

George H. Walls, Jr.CONTINUING DIRECTORS(CONTINUED)

|

| |

Term Expires/Service: |

| |

Recent Business Experience: | General Walls is the former Chief Deputy Auditor of the State of North Carolina, a position he held from 2001 through 2004. General Walls retired from the U.S. Marine Corps in 1993 with the rank of Brigadier General, after nearly 29 years of distinguished service. | |

Directorships: | General Walls has served on the Board of Directors of The PNC Financial Services Group, Inc. since 2006. In addition, he was a member of the Board of Directors of Thomas Industries, Inc. from 2003 to 2005 when the board was dismantled as a result of a divestiture. | |

Director Qualifications: | General Walls brings to the Board substantial financial acumen and experience supervising the audits of various government entities, including the Office of the Governor of North Carolina, all state agencies of North Carolina, all Clerks of Superior Court for North Carolina and all not-for-profit agencies that received state or federal funds during his tenure as Chief Deputy Auditor of the State of North Carolina, which serves him well as a member of the Audit Committee of the Board. General Walls also has significant experience in the leadership, management and ethics of large, complex organizations, aiding him in his services on the Nominating and Corporate Governance Committee of the Board. General Walls is also a National Association of Corporate Directors (NACD) Governance Fellow. In addition, General Walls understands the welding industry and at one point in time had oversight responsibility for the Marine Corps welding school and development program. | |

David H. Gunning

|

| |

|

| |

|

| |

|

| |

|

| |

G. Russell LincolnEXECUTIVE BIOGRAPHIES

The biographies of our executive officers are hereby incorporated by reference from our Form 10-K for the fiscal year ended December 31, 2013, filed on February 21, 2014, at page 9.

|

| |

|

| |

|

| |

|

| |

Christopher L. Mapes

|

| |

|

| |

|

| |

|

| |

Hellene S. Runtagh

|

| |

|

| |

|

| |

|

| |

|

| |

DIRECTOR COMMITTEES AND MEETINGS

We have a separately-designated standing Audit Committee established in accordance with SEC rules. We also have standing Compensation and Executive Development, Nominating and Corporate Governance and Finance Committees. Information on the current composition of each Committee, and the number of meetings held by each Committee during 2013, is set forth below.

| Director | Audit | Compensation & Executive | Nominating & Corporate | Finance | ||||

Harold L. Adams | — | Chair | ||||||

Curtis E. Espeland | — | — | ||||||

David H. Gunning (Lead Director) | — | — | ||||||

Stephen G. Hanks | — | Chair | ||||||

Robert J. Knoll | Chair | — | ||||||

G. Russell Lincoln | — | — | ||||||

Kathryn Jo Lincoln | — | — | ||||||

William E. MacDonald, III | — | — | ||||||

Christopher L. Mapes (Chairman) | ||||||||

Phillip J. Mason | — | — | ||||||

Helene S. Runtagh | Chair | — | ||||||

George H. Walls, Jr. | — | — | ||||||

Number of Meetings – 2013 | 5 | 6 | 5 | 5 | ||||

Audit Committee

Each of the Directors serving as members of our Audit Committee meets the independence standards set forth in the NASDAQ listing standards and have likewise been determined by the Board to have the financial competency required by the listing standards. In addition, because of the professional training and past employment experience of Messrs. Espeland and Knoll, the Board has determined that they are financially sophisticated Audit Committee Members under the NASDAQ listing standards and qualify as “audit committee financial experts” in accordance with SEC rules. Shareholders should understand that the designation of Messrs. Espeland and Knoll as “audit committee financial experts” is an SEC disclosure requirement and that it does not impose upon them any duties, obligations or liabilities that are greater than those generally imposed on them as members of the Audit Committee and the Board.

Principal Responsibilities:

appoints and determines whether to retain or terminate the independent auditors

approves all audit engagement fees, terms and services

approves any non-audit engagements

reviews and discusses the independent auditors’ quality control

reviews and discusses the independence of the auditors, the audit plan, the conduct of the audit and the results of the audit

reviews and discusses with management Lincoln’s financial statements and disclosures, its interim financial reports and its earnings press releases

reviews with Lincoln’s General Counsel legal matters that might have a significant impact on our financial statements

oversees compliance with our Code of Corporate Conduct and Ethics, including annual reports from compliance officers

reviews with management the appointment, replacement, reassignment or dismissal of the Vice President, Internal Audit, the internal audit charter, internal audit plans and reports

reviews with management the adequacy of internal control over financial reporting

|

| |

|

| |

| • | |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

A copy of this Committee’s Charter (i) may be found on our website atwww.lincolnelectric.com | ||

Compensation and Executive Development Committee

|

| |

|

| |

|

| |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

Compensation and Executive Development Committee

Each of the Directors serving as members of our Compensation and Executive Development Committee meets the independence standards set forth in the Nasdaq listing standards and each of whom is deemed to be (1) an outside Director within the meaning of Section 162(m) of the U.S. Internal Revenue Code, and (2) a “non-employee director” within the meaning of Rule 16b-3 of the Securities Exchange Act of 1934.

Principal Responsibilities:

reviews and establishes total compensation of our Chief Executive Officer and other executive officers

annually assesses the performance of our Chief Executive Officer and other executive officers

monitors our key management resources, structure, succession planning, development and selection processes and the performance of key executives

reviews and recommends to the Board, in conjunction with the Nominating and Corporate Governance Committee, the appointment and removal of our elected officers

administers our employee stock and incentive plans and reviews and makes recommendations to the Board concerning all employee benefit plans

reviews and recommends to the Board new or amended executive compensation plans

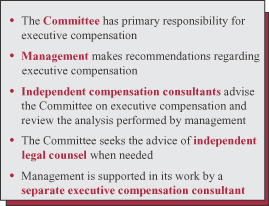

The Committee does not generally delegate any of its authority to other persons, although it has the power to delegate authority. Two exceptions to the foregoing are that the authority to delegate is not permitted with respect to awards under our 2006 Equity and Performance Incentive Plan (EPI Plan) to

any executive officers or any person subject to Code Section 162(m) and the authority to delegate is limited by Section 162(m) under our 2007 MICP, a plan that relates to awards subject to Code Section 162(m). See the Compensation Discussion and Analysis (CD&A) section below for more information on the Committee’s role with respect to executive compensation.

During 2013, the Committee adopted amendments to its Charter to reflect new Nasdaq listing requirements related to the independence of its members, as well as its advisors.

A copy of this Committee’s Charter (i) may be found on our website atwww.lincolnelectric.com and (ii) will be made available upon request to our Corporate Secretary.

Nominating and Corporate Governance Committee

|

| |

|

| |

|

| |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| Principal Responsibilities: reviews external developments in corporate governance matters, and develops and recommends to the Board corporate governance principles for Lincoln identifies and evaluates Board member candidates reviews Director compensation, benefits and expense reimbursement programs reviews periodically the quality, sufficiency and currency of information furnished to the Board by Lincoln management reviews and recommends, in conjunction with the Compensation and Executive Development Committee, the appointment and removal of our elected officers In evaluating Director candidates, including persons nominated by shareholders, the Committee expects that any candidate for election as a Director of Lincoln must have these minimum qualifications: demonstrated character, integrity and judgment high-level managerial experience or experience dealing with complex problems ability to work effectively with others sufficient time to devote to the affairs of Lincoln and these specific qualifications specialized experience and background that will add to the depth and breadth of the Board independence as defined by the Nasdaq listing standards financial literacy In evaluating candidates to recommend to the Board of Directors, in addition to the minimum qualifications discussed above and as stated in our Guidelines on Significant Corporate Governance Issues, the Committee considers whether the candidate enhances the diversity of the Board. Such diversity includes professional background and capabilities, knowledge of specific industries and geographic experience, as well as the more traditional diversity concepts of race, gender and national origin. The Committee’s process for identifying and evaluating nominees for Director includes annually preparing and discussing prospective Director specifications, which serve as the baseline to evaluate candidates. From time-to-time, we have retained an outside firm to help identify candidates, but no such firm was retained during 2013. Shareholders may nominate one or more persons for election as Director of Lincoln. The process for doing so is set forth above under the caption “May I submit a nomination for Director?” See the narrative following the Director compensation table below for specific information on the Committee’s involvement in determining Director compensation. A copy of this Committee’s Charter (i) may be found on our website atwww.lincolnelectric.com and (ii) will be made available upon request to our Corporate Secretary. | ||

Finance Committee

Principal Responsibilities:

|

| |

|

| |

|

| |

| ||

| ||

| ||

| ||

| ||

| ||

Considers and makes recommendations, as necessary, on matters related to the financial affairs and policies of Lincoln, including: financial performance, including comparing our financial performance to budgets and goals capital structure issues, including dividend and share repurchasing policies financial operations capital expenditures strategic planning and financial policy matters, including merger and acquisition activity pension plan funding and plan investment management performance A copy of this Committee’s Charter (i) may be found on our website atwww.lincolnelectric.com and (ii) will be made available upon request to our Corporate Secretary. | ||

Board Meetings

YourOur Board held five meetings in 2011. Each2013. During 2013, each of theour Directors serving in 20112013 attended at least 75% of the total number of full Board meetings as well as meetings of committees on which he or she served during 2011.(for the period served), except for Mr. Espeland. Mr. Espeland was absent from one Board meeting and one committee meeting due to a family loss and one Board meeting due to professional conflicts.

Director Independence

Each of the non-employee Director nominees and continuing non-employee Directors meets the independence standards set forth in the NASDAQNasdaq listing standards, which are reflected in our Director Independence Standards (discussed below). The NASDAQNasdaq independence standards include a series of objective tests, such as that the Director is not an employee of Lincoln and has not engaged in various types of business dealings with Lincoln, to determine whether there are any relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of the Director. To be considered independent, the Board must affirmatively determine that the director has no material relationship with Lincoln. The Board has adopted Director Independence Standards, which outline the independence standards set forth in the NASDAQNasdaq listing standards and outline specific relationships that are deemed to be categorically immaterial for purposes of director independence. The Director Independence Standards are available on our website at www.lincolnelectric.com.

During 2011,2013, the independent Directors met in Executive Session, separate from the management Directors, in conjunction with each of the meetings of the Board. The Lead Director discussed below, was the presiding Director of these sessions.

Lead Director

The Lead Director is appointed each year by the independent Directors at the organizational meeting of the Board following the Annual Meeting. The Lead Director serves as a liaison between the Chairman of the Board and the independent Directors, and presides over Executive Sessions attended only by independent Directors. The Lead Director consults with the Chairman on the format and adequacy of information the Directors receive and the effectiveness of the Board meeting process and has independent authority to review and approve Board meeting agendas and schedules, as well as the authority to request from our officers any company information deemed desirable by the independent Directors. The Lead Director may also speak on behalf of Lincoln, from time to time, as the Board may decide.

In April Harold L. Adams2013, David H. Gunning was re-appointedelected as the Lead Director for 2011-2012, a position he has held since the position was created in December 2004. Mr.2013-2014, replacing Harold L. Adams has been a Directorfollowing eleven years of Lincoln since 2002.consecutive service as Lead Director.

Board Leadership

Currently,On December 20, 2013, John M. Stropki retired from his role as Executive Chairman and as a member of our Board. Our Executive Chairman acted until his retirement as a liaison between our Board and management and offered high-level guidance to our Chief Executive Officer.

On December 21, 2013, Mr. Mapes, the President and Chief Executive Officer, also serves as thewas elected Chairman of the Board. The Board has no policy with respectin addition to the separation of these offices. The Board of Directors believes that this matter ishis other responsibilities. This action was part of theour succession planning processfor senior leadership. Our Chairman, President and that it is in our best interests for the Board of Directors to consider it each time that it elects the Chief Executive Officer. TheOfficer is responsible for planning, formulating and coordinating the development and execution of our corporate strategy, policies, goals and objectives. He is accountable for Lincoln’s performance and reports directly to our Board. Our Chairman also:

works closely with our management to develop the company’s strategic plan;

works with our management on transactional matters by networking with strategic relationships;

ensures that our Board fulfills its oversight and governance responsibilities;

ensures that our Board sets and implements our goals and strategies;

establishes procedures to govern our Board’s work;

ensures that the financial and other decisions of Directors recognizesour Board are fully, promptly and properly carried out;

ensures that there may be circumstances inall members of our Board have opportunities to acquire sufficient knowledge and understanding of our business to enable them to make informed judgments;

presides over meetings of our shareholders; and

provides leadership to our Board and sets the future that would lead it to separate these offices, but it believes that there is no reason to do so at this time.agenda for, and presides over, Board meetings.

The

Our Board believes having one individual serve as bothChairman and Chief Executive Officer and Chairman of the Board is beneficial to us, as well as consistent with recent developments ingood corporate governance matterspractices when coupled with a Lead Director. As both a Director and an officer, Mr. Stropki fulfills a valuable leadership role that the Board believes is beneficial. In the Board’s opinion, Mr. Stropki’sMapes’ dual role enhances his ability to provide direction and insight and direction on important strategic initiatives impacting us and our shareholders to both management and the independent Directors.

shareholders. The Board also believes that Mr. Stropki’sthe dual role is consistent with good governance practices. The Board, through its Nominating and Corporate Governance Committee, regularly considers developments in key areas of corporate governance including director independence. Particularly notable to this Committee have beenpractices, noting statements made by some governance commentators (such as the NACD and Conference Board and National Association of Corporate Directors)Board) who have found no reason for a split between the positions of Chief Executive Officer and

Chairman when a counterbalance, such as a Lead Director, is present.

As noted above, theour Board officially designates a Lead Director. Our Lead Director performs several important functions, including the coordination of the activities of the independent directors, providing input on agendas for Board and committee meetings and facilitating communications between the Chairman and the other members of theour Board. The Lead Director works with the Chairman, President and Chief Executive Officer and the other Board members to provide strong, independent oversight of our management and affairs.

Risk Oversight and Assessment

In the ordinary course of business, we face various strategic, operating, compliance and financial risks. Our risk management processes seek to identify and address significant risks. TheOur Board oversees this enterprise-wide approach, and the Lead Director promotes theour Board’s engagement in enterprise risk management. Additionally, the Audit Committee reviews major financial risk exposure and the steps management has taken to monitor and control risk. Board oversight includes both leadership initiatives and structured follow up and review. In 2011, theOur Board has integrated its enterprise risk management process with its strategic planning process, refining the distinction between strategic risks and operational risks. Regular review ofOur Board reviews both categories continue.regularly.

Compensation-Related Risks

We regularly assess risks related to our compensation and benefit programs, including our executive programs, and our Compensation and Executive Development Committee is actively involved in those assessments. In addition, management requested that its consultants, Towers Watson & Co., providecompensation consultants engaged by management,

has provided a risk assessment of our executive programs.programs in the past. As a result of all these efforts, we do not believe the risks arising from our executive compensation policies and practices are reasonably likely to have a material adverse effect on Lincoln.

Although we have a long history of pay-for-performance and incentive-based compensation, the programs contain many mitigating factors to ensure that our employees are not encouraged to take unnecessary risks. These factors include:

A mixture of programs that provide focus on both short- and long-term goals and that provide a mixture of cash and equity compensation;

Incentives focused primarily on the use of reportable and broad-based financial metrics (such as EBIT, net income growth and ROIC), including a mixture of consolidated and business-specific goals, with no one factor receiving an excessive weighting;

Caps on the maximum payout for cash incentives (currently 160% for the annual bonus and 200% for the cash long-term incentive program);

Stock ownership requirements for executives that encourage a longer-term view of performance;

Well-defined roles for oversight, review and approval of executive compensation, including the Compensation and Executive Development and Finance Committees of the Board and a broad-based group of functions within the organization (including Human Resources, Finance, Audit and Legal); and

A clawback policy that applies to all incentive compensation for officers from 2011 forward.

Guidelines on Significant Corporate Governance Issues

TheOur Board has adopted Guidelines on Significant Corporate Governance Issues, which we refer to as our “Governance Guidelines,” to assure good business practices, transparency in financial reporting and the highest level of professional and personal conduct. These guidelines address current developments in the area of corporate governance, including developments in federal securities law, developments related to the Sarbanes-Oxley Act of 2002 and changes in the NASDAQNasdaq listing standards. The Governance Guidelines also provide for the

annual appointment of our Lead Director and contain our majority voting policy with respect to uncontested elections of Directors as discussed below. In addition, the Governance Guidelines specify through an express

confidentiality provision that, unless otherwise authorized by the Board, Directors are not to discuss confidential corporate business with third parties, and instead are to refer all inquiries concerning confidential corporate business to the Chief Executive Officer or the Chief Financial Officer.

Majority Voting Policy

Consistent with the current trend of companies adopting majority voting standards in connection with uncontested elections of Directors, our

Our Governance Guidelines include a majority voting policy.policy that applies in uncontested elections of Directors. The Board has the exclusive power and authority to administer the policy, as well as to repeal the policy, in whole or in part, or to adopt a new policy as it deems appropriate.

Under the policy, in uncontested elections of Directors, any Director who fails to receive a majority of the votes cast in his or her favor would be required to submit his or her resignation to the Board promptly after the certification of the election results. The Nominating and Corporate Governance Committee would then consider each resignation and recommend to the Board whether to accept or reject it. The Committee, in making its determination, may consider any factors or other information that it deems appropriate, including, the reasons (if any) given by shareholders as to why they withheld their votes, the qualifications of the tendering Director and his or her contributions to the Board and Lincoln, and the results of the most recent evaluation of the tendering Director’s performance by the Committee and other members of the Board. Any Director who tenders his or her resignation under the policy shall not participate in the Committee’s recommendation or Board action regarding whether to accept or reject the tendered resignation. If a Director’s tendered resignation is rejected by the Board, the Director will continue to serve for the

remainder of his or her term and until a successor is duly elected. If a Director’s tendered resignation is accepted by the Board, then the Board, in its sole discretion, may fill any resulting vacancy or may decrease the size of the Board.

You can access our Guidelines on Significant Corporate Governance IssuesGuidelines on our website atwww.lincolnelectric.com.

Code of Corporate Conduct and Ethics

The Board also has adopted a Code of Corporate Conduct and Ethics to govern our Directors, officers and employees, including the principal executive officers and senior financial officers. We have satisfied, and in the future intend to satisfy, the disclosure requirements of Item 5.05 of Form 8-K regarding an amendment to, or a waiver from, any provision of our Code of Corporate Conduct and Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, and relates to any element of the code of ethics definition as set forth in Item 406(b) of Regulation S-K of the Securities Exchange Act of 1934, by posting such information on our website. You can access the Code of Corporate Conduct and Ethics, and any such amendments or waivers thereto (to date, there have been no such amendments or waivers), on our website atwww.lincolnelectric.com.

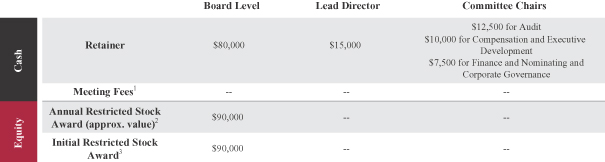

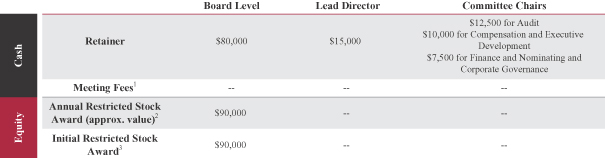

| DIRECTOR COMPENSATION |

The following table details the cash retainers and fees, as well as stock-based compensation in the form of shares of restricted stock, received by our non-employee Directors during 2011. Mr. Espeland was not a Director during 2011.2013.

| Director | Fees Earned or Paid in Cash | Stock Awards1 | All Other Compensation | Total | Fees Earned or Paid in Cash | Stock Awards1 | All Other Compensation | Total | ||||||||||||||||||||||||

Harold L. Adams | $ | 102,500 | $ | 89,977 | $ | — | $ | 192,477 | $ | 92,263 | $ | 89,981 | $ | — | $ | 182,244 | ||||||||||||||||

Curtis E. Espeland | 80,000 | 2 | 89,981 | — | 169,981 | |||||||||||||||||||||||||||

David H. Gunning | 87,500 | 89,977 | — | 177,477 | 92,619 | 89,981 | — | 182,600 | ||||||||||||||||||||||||

Stephen G. Hanks | 80,000 | 89,977 | — | 169,977 | 85,119 | 89,981 | — | 175,100 | ||||||||||||||||||||||||

Robert J. Knoll | 92,500 | 89,977 | — | 182,477 | 92,500 | 89,981 | — | 182,481 | ||||||||||||||||||||||||

G. Russell Lincoln | 80,000 | 89,977 | — | 169,977 | 80,000 | 89,981 | — | 169,981 | ||||||||||||||||||||||||

Kathryn Jo Lincoln | 80,000 | 89,977 | — | 169,977 | 80,000 | 89,981 | — | 169,981 | ||||||||||||||||||||||||

William E. MacDonald, III | 80,000 | 89,977 | — | 169,977 | 80,000 | 89,981 | — | 169,981 | ||||||||||||||||||||||||

Christopher L. Mapes2 | 60,000 | — | — | 60,000 | ||||||||||||||||||||||||||||

Phillip J. Mason | 34,600 | 125,448 | — | 160,048 | ||||||||||||||||||||||||||||

Hellene S. Runtagh | 90,000 | 89,977 | — | 179,977 | 90,000 | 89,981 | — | 179,981 | ||||||||||||||||||||||||

George H. Walls, Jr. | 80,000 | 3 | 89,977 | 5003 | 170,477 | 80,000 | 3 | 89,981 | — | 169,981 | ||||||||||||||||||||||

| 1 | On |

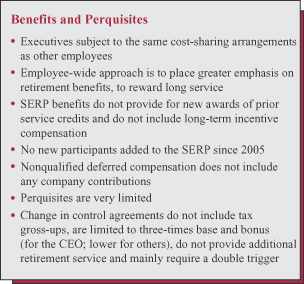

As of December 31, 2011,2013, the aggregate number of shares of restricted stock held by each non-employee DirectorDirectors was 7,269 shares.5,671 shares, except for Mr. Espeland, was not a member of thewho joined our Board during 2011.2012, and Mr. Mason, who joined our Board during 2013. Messrs. Espeland and Mason hold 4,459 and 1,844 shares of restricted stock, respectively.